Changes in the tax code affecting the sale of a business

With the ball drop just a few months away, as we ring in 2013 with friends and family, there will be many changes in the tax code immediately taking effect. There are a few changes in particular that could have a significant effect on anyone considering selling their agency. These changes include taxes imposed by ObamaCare, the increase in the long term capital gains (LTCG) tax rate from 15% to 20%, and the sunset of the favorable tax brackets put in place by the Bush era tax cuts.

Major tax legislation passed by the Bush administration during his first term, and extended by the Obama administration in 2010 is set to expire at the stroke of midnight on January 1, 2013. The two important changes associated with this are (1) the 5% increase in LTCG tax rates, and (2) the reversion back to less favorable tax brackets that were in effect prior to 2002.

The health care package signed into law by President Obama in 2010 includes a 3.8% Medicare surtax plus a 0.9% hospital insurance tax on wages and self employment income exceeding a threshold (between $200 – 250K). These taxes are sure to have an immediate impact on agency owners and their short term financial planning.

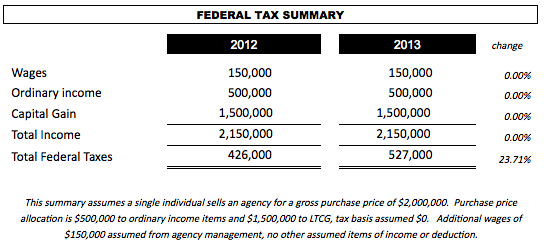

In an effort to illustrate the tax increase on the sale of an agency, the table below shows the difference in federal tax if an individual sells on December 31, 2012, or waits until 2013. While this analysis can derive innumerable scenarios, for simplicity this table assumes a single individual with $150k in wages, sells an agency for $2MM cash with zero tax basis:

There are many other financial and tax factors to consider concerning the sale of your agency that are beyond the scope of this article. However, from a very high level it is evident that there may be a significant price to pay if you hold off on selling until after December, 31st. Fleetridge Pacific is Healthcare Mergers & Acquisition advisory firm offering sell side services to homecare and hospice agencies. Darren De Vries is a Certified Public Accountant licensed in the state of California.